What Are The Best Crypto Credit Cards?

The cryptocurrency market is booming and you can now use a credit card to buy Bitcoin, Ethereum, Litecoin and other popular coins. But what are the best crypto credit cards?

As of 2019 there are only a few options available for people who want to buy cryptocurrencies with their credit cards. However, these cards have very high fees and they don’t offer any interest on your investments.

In this guide we will take a look at the best crypto credit cards that are currently available on the market.

Coinbase Shift Card

The Coinbase Shift Card is one of the most popular cryptocurrency-friendly debit cards on the market right now. It allows you to spend your cryptocurrency balances at millions of locations around the world, including restaurants or online stores such as Amazon.

You can also withdraw cash at ATMs or make purchases directly from your bank account by paying a 3% fee (minimum $10).

The Coinbase Shift Card has some drawbacks though: it doesn’t offer any rewards or benefits and it has high fees compared to other debit cards out there (3% for each purchase). However, if you want to make purchases directly from your bank account without having to convert your cryptocurrencies first then this is one of the best crypto

1. Coinbase Visa Crypto Credit Card

Coinbase has launched its Visa crypto credit card, which will allow users to spend their cryptocurrency at any online or offline retailer that accepts Visa.

The Coinbase Card is a reloadable debit card that allows users to spend their cryptocurrency anywhere in the world where Visa is accepted, according to a press release. The company says it is a “best-in-class” card from its partnership with Shift Payments, which provides a secure platform for issuing Visa cards.

Coinbase says the new product is available for U.S.-based customers who have completed identity verification and linked their Coinbase account with their Shift Payments account.

“We’re thrilled to announce the launch of the first US-issued crypto debit card,” he said in a statement quoted by Fortune magazine.”This new product expands our offering beyond buying and selling digital currency.”

Best For Multiple Wallet Selection.

We have selected the best cryptocurrency credit card for you. Coinbase Visa Crypto Credit Card is the best because it offers multiple wallet selection, zero international fees and a very low annual fee of $4.95.

Coinbase has been around since 2012 and was originally designed to be a place where people could buy and sell Bitcoin, but they have grown over time to include many other cryptocurrencies and services.

Coinbase is one of the most popular cryptocurrency exchanges in the world, supporting trading of Bitcoin, Ethereum, Litecoin and now Bitcoin Cash as well.

The exchange has grown rapidly in popularity due to their user-friendly interface, low fees (especially compared to other exchanges), extensive support for fiat currencies (USD, EURO), security features like 2-factor authentication,

tight integration with major banks allowing easy ACH transfers from your bank account directly into your Coinbase account for instant purchases without any fees at all when buying cryptocurrency with your bank account or debit card

. They also have an iOS app and Android app available for mobile trading which makes it easy to buy or sell on the go when you are traveling or just away from your computer.

The Coinbase Visa card is issued by Metropolitan Commercial Bank (MCB) and can be used anywhere that Visa is accepted which includes ATMs worldwide with

Key Features

Coinbase Visa Crypto Credit Card.

Access to a Coinbase account with USD $5,000 minimum balance.

Global Coverage.

3x points on travel and dining at restaurants worldwide.

1x point on all other purchases.

No annual fee for the first year.

Up to 6% back in rewards for travel and dining.*

Earn 3x points for each dollar spent on travel and dining at restaurants worldwide, and 1x point for all other purchases worldwide.* Eligible travel includes flights, hotels, homestays, car rentals and more**, but does not include Uber or similar services***

2. Gemini Crypto Credit Card

The Gemini Card is a Visa® Prepaid Card issued by Bancorp Bank pursuant to a license from Visa U.S.A. Inc. This card can be used anywhere Visa is accepted.

ATM withdrawals are limited to $500 per transaction, $1,000 per day and $2,500 per 30-day period; additional fees apply for higher ATM withdrawal amounts as set out in the fee table below.

The funds on the card are FDIC insured through the issuing bank (Bancorp Bank). The card may be used to make purchases wherever Visa debit cards are accepted in the U.S., including online and internationally where available, subject to any limitations imposed by your credit union or other financial institution in connection with its issuance of the card or its participation in this program.

This card cannot be used for recurring payments such as subscriptions, memberships or online services like Netflix and Spotify.

The Gemini Crypto Credit Card provides an easy way for Gemini customers to purchase bitcoin and ether using their credit line.*

Best Overall For Crypto Credit Cards.

Gemini Crypto Credit Card. Best Overall For Crypto Credit Cards.

The Gemini card is the best overall option for crypto credit cards because it provides a range of features and benefits that are unavailable with other issuers. These include:

Low fees. The annual fee is $95 and there’s no foreign transaction fee.

Flexibility on spending limits. You can set your own limit on certain transactions, such as cash advances or cash-like withdrawals from ATMs.

No minimum balance requirement. This can be a boon for people who don’t have much in their accounts at any given time.

Cash back rewards system. You receive 1% cash back on all purchases made with the card, which can be redeemed for statement credits against future purchases or deposited into your bank account once a month along with your monthly statement balance (if you have sufficient funds in the account).

Key Features

Gemini Crypto Credit Card. Key Features:

1.Free crypto trading – Buy, sell and trade digital assets without paying any trading fees.

2.Buy crypto with credit card – Trade BTC, ETH, LTC, XRP, BCH, EOS and XLM using a Visa or Mastercard to buy crypto at the best available rate.

3.Exchange crypto into fiat currency – Exchange your cryptocurrencies into USD using a debit card or bank account.

4.Send money to anyone in the world – Send money instantly to friends and family members if you have their email address or phone number with our TransferWise integration!

Gemini Crypto Credit Card. Key Features:

The card is available to U.S. residents only.

It’s issued by Metropolitan Commercial Bank, and it’s powered by Stripe.

The card is linked to your Gemini account, so you can use it to spend cryptocurrencies as well as fiat currency.

The card includes an EMV chip and a magnetic stripe.

You can add funds to your card from your Gemini account or from any external source that accepts MasterCard payments, including Coinbase Commerce and Shopify POS systems.

3. Crypto.com Crypto Credit Card

Crypto.com has launched a crypto credit card that lets you pay for goods and services with Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and Binance Coin (BNB).

The new card was announced by the company on Wednesday, May 22, 2019. It is available in Hong Kong and Singapore, but it will soon be available in other countries too.

The Crypto.com Crypto Credit Card can be used anywhere that accepts Mastercard payments.

You can also use it to withdraw cash at ATMs that accept Mastercard debit cards. The company said that it will soon add more cryptocurrencies to its portfolio of accepted currencies on the card.

Best For Instant Crypto Rewards.

The Crypto.com Crypto Credit Card is the best credit card for instant crypto rewards. You can use it to buy goods and services, as well as transfer your crypto holdings to other people. The card also comes with a host of bonuses and rewards that you can use to save money on your crypto purchases.

The Crypto.com Crypto Credit Card offers an instant 0% crypto purchase APR for the first 6 months, giving you time to earn points and cash back on all your purchases.

It also comes with no annual fee, which is rare among cryptocurrency-focused credit cards.

The Crypto.com card has some drawbacks too: You can only use it at certain retailers and restaurants (for example, it doesn’t work at Walmart), and you need to have at least $500 in your account before making a purchase or transfer between accounts (although there are no fees associated with this).

If you want the freedom to spend your cryptocurrency wherever Visa is accepted without paying transaction fees or having to convert it into fiat currency first, then this is the card for you.

Key Features

Crypto.com Crypto Credit Card

The Crypto.com credit card is a pre-paid card that allows users to spend cryptocurrencies at any retailer that accepts credit cards.

The card is issued by a company called Wirecard and can be used in stores or online.

The Crypto.com credit card can be used anywhere Visa is accepted, including ATMs and stores. Users can also withdraw cash from ATMs with their Crypto.com crypto credit card and use the funds to make purchases anywhere Visa is accepted.

The Crypto.com crypto credit card doesn’t have any transaction fees and it doesn’t cost anything to order one either although there will be an annual fee of $120 (which can be waived).

The card comes with an EMV chip and an NFC antenna, so it’s secure and easy to use in person or online.

4.blockfi

BlockFi has announced the launch of a new rewards credit card. The BlockFi Rewards Credit Card is designed to reward customers for using their credit card, with points that can be redeemed for cash back, travel or charitable donations.

The BlockFi Rewards Credit Card is available to residents in all 50 states and it offers 0% APR on purchases, balance transfers and cash advances for 12 months. After that period, a variable rate will apply based on the prime rate plus 6%.

There are no penalty rates or fees for late payments or exceeding your credit limit.

Despite the fact that BlockFi is an online-only bank, it has received approval from both MasterCard and Visa to issue its own prepaid cards and credit cards. As part of this process, BlockFi was required to meet various security and compliance requirements set by each network.

Best For Crypto Rewards.

Best For Crypto Rewards. BlockFi Rewards Credit Card.

If you’re looking to earn rewards on your crypto purchases, the BlockFi card could be a good choice. If you spend $10,000 or more in a year on the card, you get 1% back in cash rewards.

There are no annual fees and no foreign transaction fees, which is ideal for those who want to use their cryptocurrency-based credit card internationally.

The downside is that there is no sign-up bonus just the 1% cash back rate that kicks in after hitting the $10,000 spending threshold.

Best For Low Interest Rates. Goldman Sachs Mastercard Platinum Cashback Credit Card

If you’re looking for a low-interest rate credit card that also offers rewards, then this one from Goldman Sachs might be a good fit. While it has an annual fee of $0 and no foreign transaction fees, its APR is higher than average at 23%.

It also offers 0% APR on balance transfers for 12 months and 0% APR on cash advances for 18 months (or 3 months longer if you make payments by check).

Key Features

The BlockFi Rewards Credit Card offers several key benefits, including:

No annual fee.

$100 bonus for new cardholders.

1% cash back on all purchases.

0% introductory APR for 12 months on purchases and balance transfers (then a 17.99% – 25.99% variable APR).

No foreign transaction fees.

The BlockFi Rewards Credit Card is a good option for anyone who wants to earn some cash back on their everyday spending without paying an annual fee or interest charges. It’s also a good choice if you’re trying to build credit, because it doesn’t have an annual fee and it has no foreign transaction fees.

5. TenX Visa Card

TenX is a card that can be used to spend your cryptocurrencies anywhere Visa is accepted. It’s just like any other debit card, except that it allows you to make purchases using digital currencies.

The TenX card will be available in the third quarter of 2018 in Singapore and Europe, with plans to expand globally in 2019.

The TenX card allows users to spend their cryptocurrency holdings anywhere Visa is accepted. There are no monthly transaction fees, nor limits on how much you can spend or how many times you can use it per month.

TenX cards are issued by WaveCrest Holdings Limited (Visa). To date, WaveCrest has issued more than one million cards across Europe, Australia and Asia Pacific regions.

Prepaid Card Model

TenX has developed a prepaid card model that allows users to top up their accounts directly from their wallets through the TenX wallet app. This means that users don’t need to deposit funds into an account before making payments or withdrawing money from ATMs – they just pay for goods or services directly from their wallet through the TenX app.

Best For Instant Crypto To Cash Conversion

TenX Visa Card. Best For Instant Crypto To Cash Conversion.

TenX is a cryptocurrency wallet, debit card and financial services company. It will be providing users with the ability to pay with cryptocurrencies in everyday situations.

The company was founded by Julian Hosp, Toby Hoenisch and Michael Sperk. TenX has been in operation since 2015 and works with PayPal to handle its transactions.

The first TenX card was released in 2017, which allows users to instantly convert their crypto assets into fiat currency at point of sale terminals worldwide. It is currently available in 130 countries and supports over 1,000 cryptocurrencies including Bitcoin, Ethereum and Litecoin.

The wallet has a built-in security feature that allows users to set up two-factor authentication on their accounts and lock them down if they go inactive for a period of time. There are no fees associated with TenX cards or deposits, making them one of the most affordable options available today!

Key Features

TenX Visa Card. Key Features

TenX allows you to spend your cryptocurrencies at any merchant that accepts Visa contactless payments. TenX is a company that offers physical and virtual Visa cards, which can be used in any ATM around the world to withdraw cash or make purchases online or in-store.

Your TenX card will be delivered to you by mail within 15 days after your identity has been checked and verified by TenX’s compliance team.

You can use TenX with any cryptocurrency wallet or exchange that supports Ethereum (ETH), including Coinbase, Binance, Bittrex, Bitfinex and more.

TenX charges no fees for using their service, but you must pay a $15 monthly fee for having an account with them.

This doesn’t apply if your account balance is less than $0 USD or if you have over $10 USD worth of tokens on deposit at all times.

6. Swipe Visa card

The Swipe Visa card is a reloadable prepaid debit card that allows you to build credit, manage your money and enjoy mobile pay.

You can use this card to shop online and in-store, get cash at ATMs, or send money to friends and family.

The Swipe Visa card is issued by MetaBank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and can be used everywhere Visa debit cards are accepted.

It is not a credit card, nor does it have a line of credit so you can only spend what you add to your account.

Use the money on your Swipe Visa Card to pay bills or buy things anywhere that accepts Visa debit cards – including online shopping, groceries, utilities and more!

Swipe Visa Card Terms & Conditions

Best For Virtual Crypto Cards

The Swipe Visa card is a great option for virtual cryptocurrency cards. It comes with a 1% foreign exchange fee and no annual fee.

The card is accepted anywhere that accepts Visa credit cards, which is a big plus considering the wide range of merchants that accept it.

The card can be used to make purchases in any currency and will automatically be converted into the currency of the country where you are shopping. If you use your card at an ATM, cash withdrawals will also be converted into the local currency at an exchange rate that’s better than what you get from your bank or credit union.

Another advantage of using the Swipe Visa card is that it can be used as a backup payment method on websites that don’t accept cryptocurrency payments, such as Amazon or eBay.

The downside of this card is that there’s no option to add additional debit cards (i.e., family accounts). But if all you need is one card to access funds from multiple crypto wallets, this may not be an issue for you

Key Features

Swipe Visa card. Key Features:

- Visa Credit Card

- Rewards Program

- No Annual Fee

- No Payment Fee

- Contactless Payments

Swipe Visa card. Key Features:

2x points on gas, grocery and drugstore purchases.

No annual fee.

Earn an introductory bonus of 25,000 points after spending $1,000 in the first 3 months of card membership.

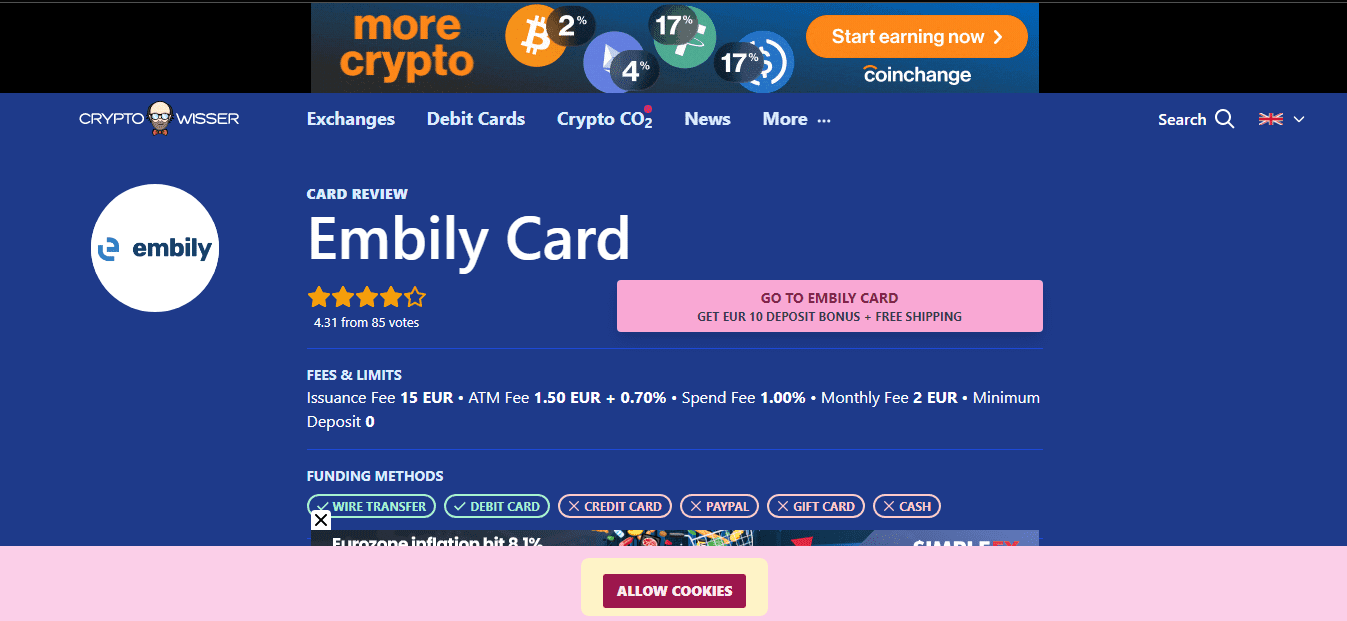

7. Embily Crypto Card

The new Embily Cryptocurrency Card is an innovative and convenient financial tool that allows you to convert your crypto assets into fiat money using the Embily platform.

The card is available to all users who have completed KYC verification and have a verified account on the platform. The card can be issued by request, but only for verified users.

How does it work?

To use the card, you need to provide certain information, including your name, surname, date of birth and address. If your application is accepted by our team, you will receive a confirmation email with all the information about the card.

There are no hidden fees or additional charges associated with using this service.

Benefits of using Embily Crypto Card:

1)You can use this card anywhere in the world where MasterCard is accepted;

2)You can use it as an international debit card;

3)You can use it as an ATM card;

Best For The Simplest Crypto Credit Card Experience

Embily Crypto Card. Best For The Simplest Crypto Credit Card Experience.

Embily is a crypto credit card that provides simple, secure and fast payment experience. Embily Crypto Card is the first crypto-based credit card that you can use to pay in the real world with your assets. Embily will make it easy for you to spend your crypto assets anywhere with just one tap.

Embily is based on the Ethereum blockchain, which means that all transactions are transparent and safe. Embily also allows you to receive payments directly into your bank account without any fees or commissions.

This makes it possible for you to use your crypto assets as real cash at any time and anywhere!

Key Features

Embily Crypto Card is a prepaid debit card that allows you to spend your cryptocurrencies anywhere that accepts Visa. The card is powered by Everex, a fintech company based in Thailand.

The Embily Crypto Card has been designed with the user in mind. It comes with a simple interface and easy-to-use features. You can use it to pay wherever Visa is accepted and withdraw cash from ATMs worldwide.

Key Features:

1) Spend Cryptocurrencies Anywhere That Accepts Visa

2) Pay with Bitcoin or Ethereum at over 35 Million Merchants Worldwide**

What Are Crypto Credit Cards?

A crypto credit card is a type of payment card that can be used to make online or offline payments. Crypto credit cards are linked to your cryptocurrency wallet, so you can use them for any type of transaction.

Crypto credit cards are an alternative method of payment for people who want to use digital currencies instead of traditional currencies. They’re also useful for people who want to use their crypto assets but don’t have access to an exchange or bank account where they could convert them into fiat money.

You can get a crypto credit card from any major bank, like Citibank or Bank of America, and it will look just like any other credit card except for the fact that it has a different logo on it.

How Do Crypto Credit Cards Work?

Crypto credit cards work just like regular credit cards you can use them at any store or online shop that accepts them as payment. The difference is that instead of paying with dollars or euros, you’ll be paying with cryptocurrency tokens such as bitcoin (BTC), ethereum (ETH), litecoin (LTC) and more.

Some crypto credit cards allow you to load your account with fiat currency first and then convert it into cryptocurrencies when

What Are The Benefits Of Crypto Credit Cards?

Many people have been asking what are the benefits of crypto credit cards? The answer is that there are many benefits to using a crypto credit card.

The first benefit is that you can use your Crypto credit card anywhere that accepts Visa or Mastercard. You can use your crypto credit card to purchase anything from groceries, gas, clothes and much more with no problem.

Another benefit of using a crypto credit card is that you can buy things online without needing to use your bank account information. This makes buying things from websites safer and more secure because you do not need to give away your bank account information like you would if you were using a normal bank account.

It also helps keep your personal information private because it does not show up on any statements or bills.

Some other benefits include getting cash back on purchases, earning rewards points or miles when making purchases and many others depending on the type of crypto currency used by the company issuing the credit card.

You Can Use Your Cryptos In Everyday Life – Just Like Regular Currency

The best thing about cryptocurrencies is that you can use them as regular currencies, just like any other currency. In fact, there are many ways to spend your crypto in everyday life. You can use your coins to buy things online or offline just like you would with regular currency.

Online Stores Accepting Crypto Payments

Many online stores accept crypto payments and some of them have already been accepting crypto payments for years. The most common examples include Overstock and Newegg.

These are companies that sell products ranging from electronics to furniture and they also accept cryptocurrency as a form of payment. There are many other online businesses that accept cryptocurrency as payment, so you should check if your favorite shop has an option where you can pay with cryptocurrency.

Pay Your Bills With Crypto

Cryptocurrencies are digital forms of money, so it’s only natural that we want to use them for paying our bills instead of using cash or credit cards. You can pay your bills with Bitcoin easily by using BitPay or CoinPayments wallet apps on your mobile device and sending funds directly to your bank account.

If your utility provider doesn’t accept Bitcoin yet (which is unlikely), then you

They’re Perfect For Travel Rewards

If you’re looking for a new credit card to help you earn rewards points, I’m here to tell you about the perfect travel rewards credit card.

The Chase Sapphire Preferred Card is my favorite travel rewards credit card. It offers 2 points per dollar spent on dining and travel and 1 point per dollar spent on everything else.

It also has a 50,000 point sign up bonus after spending $4,000 in 3 months.

That’s not all though! The Chase Sapphire Preferred Card has an annual fee of $95 which is waived for the first year, so you can enjoy all these benefits without paying anything extra up front.

The great thing about this card is that it’s flexible enough to be used as either a cash back or travel rewards credit card based on your needs at the time.

If you have one specific trip planned then use it as a travel rewards card and rack up those points! If not then use it as a cash back credit card for everyday purchases until you need to book another flight or hotel room.

Rewards Include An Intro And Spend Bonuses

The best credit card rewards are those that offer an intro bonus and spend bonuses. With this in mind, we’re looking at the top five credit cards with the best intro and spend rewards in 2019.

- Chase Freedom Unlimited

- Barclaycard Arrival Premier World Elite Mastercard

- Discover it Cash Back

- Capital One SavorOne Cash Rewards Credit Card

- Bank of America® Cash Rewards credit card

They Come With Fraud Protection

The thing that most people don’t realize is that credit cards come with fraud protection. That’s right, if your card is used fraudulently and you report it within 60 days, you have zero liability.

If you report it after 60 days and the merchant does not have anti-fraud software in place (which most do), you could be liable for up to $500.

Fraud protection is an important feature because it offers a degree of peace of mind when purchasing online or over the phone.

This doesn’t mean that you shouldn’t check your monthly statement carefully, but it does mean that if something does go wrong, you won’t be stuck paying for something you didn’t buy.

Factors To Consider When Choosing A Crypto Credit Card

You’ve probably heard about the growing popularity of crypto credit cards. If you’re not familiar, these are credit cards that allow you to spend your crypto assets anywhere.

They work just like regular debit or credit cards, except that they can only be used for crypto purchases.

There are a number of factors to consider when choosing a cryptocurrency card How easy is it to use?

The main goal of a crypto credit card is to make it easier for consumers to spend their crypto assets. But if it’s too difficult to use, then the whole point is lost. Luckily, there are many options on the market today that make spending your coins easy and convenient! What fees do they charge

The fees vary depending on the provider and type of card you choose but can range from 1%+ per transaction up to $15 per month in some cases. In general, fees tend to be higher than those charged by traditional cards but this shouldn’t put you off if you are looking for a long-term solution.

What does their customer service look like?

There is no point paying high fees if your card doesn’t work properly or if the company

Card Security

Protecting your information is the most important thing you can do to keep your card safe.

Here are some tips for making sure you’re protecting your personal information:

Protect your PIN. Don’t share it with anyone, and don’t write it down where others can find it.

Keep track of your purchases. Check your account online regularly, or sign up for email or text alerts to keep track of charges on your card. If there’s an unauthorized charge, contact us right away so we can help resolve the issue.

Be careful when using a debit card at an ATM or unattended payment terminal, like at a gas station pump or grocery store checkout line.

It’s possible someone could be watching you enter your PIN code and take note of it. To reduce this risk:

Use only ATMs inside banks or other well-lit locations (not outside at night).

Shield the keypad when entering your PIN code so no one can see what numbers you are entering or standing close enough to hear what you’re saying over the sound of the transaction processing machine.

Amount Of Credit Card Rewards

Credit card companies offer all kinds of rewards to get you to use their cards. The best rewards programs offer a lot of ways to earn points, miles or cash back.

But there’s one thing that every credit card rewards program has in common: They all have an expiration date. That’s why it’s important to know how long your rewards will last before they disappear into thin air.

Here are some general guidelines for how long most credit card rewards last:

Airline miles: American Express Membership Rewards and Chase Ultimate Rewards points can both be redeemed for airfare, but the expiration dates vary depending on the airline you choose.

For example, American Express points expire after 18 months if you don’t get rid of them by booking travel through its portal. Chase Ultimate Rewards expire after five years, although there are some exceptions (Chase Sapphire Reserve members get two free nights at hotels each year).

Other airlines often have similar restrictions on how long you have to use your miles before they’re gone forever.

Cash-back cards: Cash-back cards typically have annual percentage rates (APRs) between 0% and 25%, which means that even if you don’t pay off your balance every month, you’ll at least be earning interest on your purchases as

Bank Account Transfers

Transferring money between accounts is a simple process that should take only minutes. If you have a bank account at another institution and want to transfer money into your Simple account, you can do so from your computer or mobile device.

We recommend using the “Send Money” feature in the Simple mobile app for faster and more secure transfers. You can also use our online transfer tool if you prefer not to use your smartphone or tablet.

To send money from another institution:

Log in to your Simple account on a computer or mobile device.

In the top-right corner of any page, click on the icon that looks like two stacked squares with an arrow coming out between them.

Select Send Money from your available options. The following page will open:

Enter the amount of money you want to send along with a reference number (if desired) in the “Pay To” field, then click Continue. This will bring up instructions on how to send money from your other account:

Once complete, click Confirm Transfer and enter your password when prompted by Simple’s security system (unless you’re already logged in).

Annual Fee

Annual fee is a charge that you pay to your credit card issuer each year, in addition to the interest charges and other fees that are charged when you use the card.

The annual fee can be a fixed amount or it can vary based on the type of card you have and how much money you’ve spent on the card.

For example, if you have a rewards credit card that offers cash back for every purchase you make, then you’ll usually pay an annual fee of $75 or $99.

But if your rewards card doesn’t offer any cash back, then it’s likely that there will be no annual fee at all.

Most credit cards charge an annual fee because they’re designed to make money for their issuers over time not just during one calendar year but over several years.

This is especially true with premium cards (like platinum cards) that offer exclusive benefits and services such as concierge service or travel perks like access to airport lounges

Fees For Foreign Transactions

The fees for foreign transactions are charged to the merchant account that is used for the foreign transaction. The fees are based on a percentage of the transaction amount and can range from 2% to 3%.

The following fee information applies to all of our merchant accounts:

Foreign Transaction Fee – A 2% foreign transaction fee is added to each credit and debit card transaction that is processed outside of Canada or made using a foreign-issued card. This fee is charged by most merchant account providers in Canada.

International Transaction Fee – A 1% international transaction fee is added to each credit and debit card transaction that is processed outside of Canada or made using a foreign-issued card. This fee is charged by most merchant account providers in Canada

Signature Credit Card

The Signature Credit Card is a premium credit card that offers a number of rewards and benefits to its users. The card was originally issued by Citibank and is now issued by JP Morgan Chase.

It is a Visa Signature card which means it has all the benefits of a regular Visa card plus additional benefits that can be used anywhere in the world.

The Signature Credit Card has an annual fee of $295, but this is waived for the first year. There are also no foreign transaction fees on purchases made outside of the country.

Signature Benefits

Signature Benefits are a set of perks that come with your Signature Credit Card which include:

Visa Infinite Concierge Service: This service provides 24-hour access to personal assistance from agents who will make reservations at hotels, restaurants and more. You can also use their travel planning services to help you find flights, plan your itinerary and more.

This service is provided by Live Ops, an in-house concierge provider for Chase customers.

Visa Infinite Luxury Hotel Collection: This program offers exclusive hotel discounts for members at luxury properties around the globe including Ritz Carlton Hotels & Resorts, Waldorf Astoria Hotels & Resorts, St Regis Hotels & Resorts

Credit Card Material

Credit card material is the type of plastic used in credit cards. There are two main types of credit card material: PVC (polyvinyl chloride) and PET (polyethylene terephthalate).

The main difference between these two materials is that PVC is made from oil and plastics, while PET is made from petroleum and natural gas.

PVC credit cards are more likely to be damaged by heat than PET cards. PVC cards also have a lower melting point than PET cards, which means they may deform if exposed to direct sunlight for too long.

Eligible Purchases

The following purchases made with your Card Account are eligible for Purchase Protection under the Mastercard Purchase Protection Plan:

- Goods purchased in Australia, while travelling internationally or while in transit including goods purchased from international websites.

- However, please note that goods purchased overseas may be subject to foreign currency exchange rates and associated fees and charges.

- Goods purchased from a retailer’s website if the goods are delivered to Australia after being ordered from the retailer’s website.

- Purchases made with your Card Account at any participating merchant location in Australia (including online merchants) where you can use your Card Account to pay for goods and services (for example, restaurants, entertainment and travel).

- Balance transfers, cash advances and convenience cheques obtained with your Card Account

Card Ownership

Your credit card is a valuable asset, and you should treat it as such. Here are some tips to help you protect your cards:

Keep your cards in a safe place.

Don’t leave them in your wallet or purse. If your wallet or purse is stolen, the thief could use it to make purchases on your behalf.

If you do leave them in your wallet or purse, be sure to take them out when you’re not using them.

When traveling with a card, keep it somewhere different from cash. For example, if you have a wallet that contains only cards and no cash, consider putting it in a different pocket than the one where you normally keep your cash.

Make sure everyone who lives with you knows about the importance of protecting their cards.

Signup Bonus And Various Incentives

Signup Bonus: The signup bonus is the reward you get when you sign up for a new account. If you have never played at an online casino before, it is common for them to offer a welcome bonus or other incentives to encourage you to sign up.

These bonuses are usually given in the form of free spins or match deposit bonuses, which allow you to play with real money but without risking any of your own money.

Welcome Bonuses: Welcome bonuses are given by online casinos as a way to encourage players to make their first deposit and stay with the site.

These bonuses are usually given in the form of free spins or match deposit bonuses, which allow you to play with real money but without risking any of your own money. Some casinos also offer reload bonuses that can be claimed after a certain number of deposits have been made.

No Deposit Bonuses: No deposit bonuses are given by online casinos as a way to attract new customers and encourage them to register an account and start playing at their site. Some casinos may even give out free spins on certain slot machines, meaning that there is no need for players

Best Crypto Credit Cards – FAQ

What is a crypto credit card?

A crypto credit card is a payment card that lets you make purchases with your cryptocurrency of choice. They work like regular debit and credit cards, but instead of using fiat currency, they allow you to pay in cryptocurrency.

Are there any fees associated with using a crypto credit card?

Yes, there are fees associated with using a crypto credit card. These fees are paid by the user and can be charged directly by the issuer (in this case, Amex) or indirectly by the merchant (in this case, Walmart).

They usually take the form of an annual fee and/or foreign transaction fees. The exact details will vary depending on your specific card product.

How do I use my Crypto Credit Card?

You can use your Crypto Credit Card just like you would use any other type of payment card. Simply swipe it at checkout or insert it into an ATM machine and follow the instructions on screen.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to have a stable value, unlike most other digital currencies whose values can fluctuate wildly. Bitcoin’s price, for example, has fluctuated between $1,000 and $20,000 over the years.

Stablecoins promise to offer the benefits of cryptocurrency without the volatility. They are built on a blockchain that tracks their value against a fiat currency like the U.S. dollar or euro.

The first stablecoin was introduced in 2013 by BitShares with BitUSD, but it wasn’t until 2017 when Tether (USDT) entered the market that stablecoins started gaining mainstream attention.

Tether (USDT) is currently one of the most used stablecoins in the world. It has a market capitalization of about $2 billion and is used as an intermediary for transactions involving Bitcoin at times when there are periods of high volatility in the market price of Bitcoin and other cryptocurrencies.

What Is Statement Credit?

A statement credit is a reduction of your credit card balance as a result of a transaction. The amount you receive as a statement credit varies from one issuer to another, but it can be up to 100% of the cost of the purchase.

Statement credits are typically used to reimburse you for travel purchases or to give you a discount on an item that you bought.

For example, if you purchase an airline ticket with your credit card and the airline goes bankrupt before you can use it, you may be able to get your money back through a statement credit.

What Is a Credit Card Statement Credit?

What Are Exchange Fees?

In the world of investing, there are two main types of exchanges: the traditional stock exchange and the cryptocurrency exchanges. When you want to trade stocks or options, you typically use a traditional exchange.

These exchanges have high fees because they need to cover their costs for operating a brokerage firm.

If you want to trade cryptocurrencies on an exchange platform, you will be using a cryptocurrency exchange. In this article, we are going to discuss what exchange fees are and how they work.

What Are Exchange Fees?

There are many factors that can affect the price of any given currency pair on an exchange platform. Some of these include:

The size of your order

The amount of time it takes for your order to complete (this includes confirmation time)

What’s The Difference Between A Prepaid Debit Card And A Crypto Credit card?

What’s the Difference Between a Prepaid Debit Card and a Crypto Credit card?

The main difference between a cryptocurrency credit card and a prepaid debit card is that the former allows you to spend your crypto balances, while the latter is just an alternative way to store your coins.

A crypto credit card allows you to spend your cryptocurrencies (BTC, ETH, LTC, etc.) in any country that accepts Visa or Mastercard as payment options. This means you can use it anywhere where traditional fiat currency is accepted.

Crypto debit cards are not tied to any particular cryptocurrency exchange and therefore don’t require KYC verification. They are also cheaper than their fiat counterparts some of them even come with offers like zero fees for certain purchases (for example, Revolut offers free ATM withdrawals). The downside to these cards is that they usually require some kind of ID verification before they can be used.

Prepaid debit cards are issued by banks and other financial institutions as well as by various other companies such as PayPal or Google Pay they allow you to store money on them in order to make payments with them later on.

You can use prepaid cards at any ATM machine or in stores where they are accepted as payment methods

Best Crypto Credit Cards Wrap Up

If you have been searching for the best crypto credit cards, then you have come to the right place.

The cryptocurrency industry is booming. However, there are many individuals who do not understand how this works and what it takes to get involved in this revolutionary industry. If you want to know more about cryptocurrencies and what they have to offer, read on!

Cryptocurrency credit cards are becoming more popular each day because they allow people to make purchases with their cryptocurrency without having to convert their coins into fiat currency first. This means that you can use your cryptos as a form of payment at any time without worrying about losing money due to exchange rate fluctuations or other factors that may affect the value of your coins at any given time.

What Makes A Good Crypto Credit Card?

There are a few things that make a good crypto credit card:

Low Annual Fee – This should be one of the first things you look for when deciding which crypto card is best for you. The annual fee should be low enough so that it does not limit your purchases too much but high enough so that it’s worth paying for each month. Make sure that any annual fee included with your card does

The post 8 Best Crypto Credit Cards in 2022 [Complete Guide] appeared first on Filmmaking Lifestyle.