Amanda is a long-time reader and a familiar presence in the comments here, and I’m delighted she chose to participate!

I always send readers the ten usual questions, along with some extras they can choose to answer if they like, and Amanda decided to answer a lot of the extra questions. So, we get the chance to know her really well today. 🙂

1. Tell us a little about yourself

I am a historian who studies race and banking in American history.

Our family at Multnomah Falls on a home exchange to explore the Pacific Northwest in 2019.

My husband (a graphic designer who runs his own studio) and I celebrate our twentieth wedding anniversary this May.

We have four kids between the ages of four and twelve, and we split our time between Richmond, Virginia and the rural community where we grew up.

I love books, old houses, personal finance, and travel.

2. How long have you been reading The Frugal Girl?

I started reading The Frugal Girl around 2011 when our oldest was a toddler and I was thinking about maybe leaving my first career in central banking. I think I found the blog when I was learning to bake.

I ended up reading through all the way to the beginning because I found Kristen’s writing so engaging. And I wanted to have four kids, so I was fascinated to get my first peek into the life of a big family.

3. How did you get interested in saving money?

I am a saver by nature and nurture. I can’t remember a time when frugality didn’t come natural to me.

But I was also raised in a family of savers. My parents grew up watching their own parents make poor financial decisions, and they were determined to raise us in a more financially stable environment.

4. What’s the “why” behind your money-saving efforts?

I realize now looking back that my parents—especially my dad—passed along to me a certain level of their own financial trauma. They were (and are) frugal because they had an intimate knowledge of what poverty felt like.

Even now when they are comfortably retired, they can’t shake the feeling that the wolf could be back at the door at any minute.

When my husband and I started our careers, I was frugal because I was scared to be without, just like I learned from my parents. I quickly realized that we both had good career paths. We would probably be okay. It was empowering to realize that frugality was not just a tool to provide for our basic needs, but could help us craft the life we wanted.

My husband and I have always generally been on the same page about money and values, but when we had kids and our careers took off, we started more regularly talking about what we wanted to accomplish in our lives. Our financial goals roll up to those big life goals.

Our goals have shifted a bit over the last decade or so, but having that clear vision of where we want to go and who we want to be has continued to guide our frugality.

5. What’s your best frugal win?

Hmmmm, this is such a good question. Okay, I’ve got two because what’s better than one, best frugal win but two best frugal wins?!

I love to travel, but I realized that my frugal heart would not be able to take big, expensive trips with four kids (and really doesn’t everything seem big and expensive with four kids).

So, we started traveling via home exchange when our oldest was a baby. That’s where you swap homes with another family. It means that not only are our accommodations free when we travel, but we usually also have access to a washer/dryer and kitchen.

We end up making most meals at “home” while we explore new places.

Our oldest in Bali on a home exchange in 2015. He is looking out over a rice paddy. We hired a local guide who took us to the most amazing restaurant on the top of a mountain.

Home exchanging is such a blessing!

We have been able to travel to beaches in Florida, North Carolina, and Virginia. We’ve been to Utah, Bali, Iceland, Rhode Island, and the Pacific Northwest.

And we’re hoping to go to California this summer.

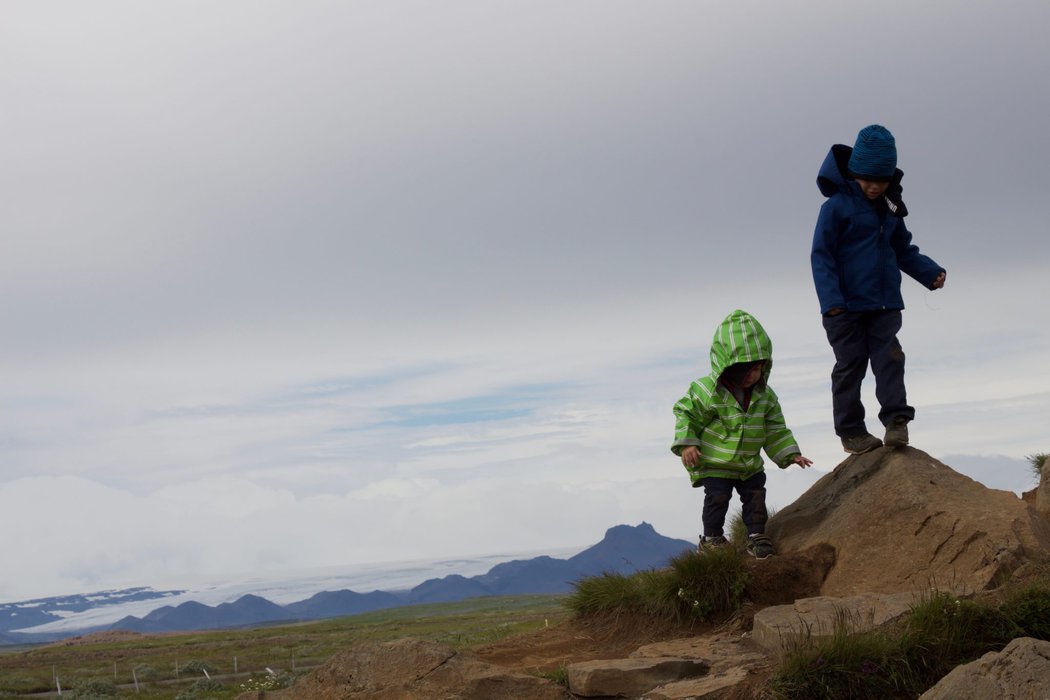

Our two oldest boys on a home exchange to Iceland in 2017. The white you can see among the black mountains in the background is a glacier. The jacket worn by the youngest was a happy frugal accident of home exchange. Our exchange partners had kids about the size of ours and generously told us we could use their kids’ extra outerwear while staying in their home.

Traveling by home exchange has saved us so much money and given us wonderful local experiences we would never normally have enjoyed.

But I have probably saved even more money through my old friend, the System. I am the queen of figuring out a system to keep things running smoothly in the house, and in other areas of life, to prevent having to spend money to solve problems. Having a system of menu planning, grocery shopping, and food prep is an example.

In our house, six people need to eat three times a day, every day. If I had to stop and figure out what we were going to eat and who was going to prepare it every few hours we would end up eating a lot of take-out pizza.

Instead, my husband and I have systems in place so that food is on the table when it is supposed to be.

I’ve also got financial systems to make sure the bills are paid on time, clothing systems to make sure everyone has clothes that fit in the right season without spending an arm and a leg, and maintenance systems to make sure little problems in the houses and cars don’t turn into expensive repairs.

6. What’s an embarrassing money mistake you’ve made?

I’m not sure if these qualify as mistakes, but I have done a bunch of frugal stuff that was embarrassing.

I was determined to drive my first car until it had half a million miles if only to buck the stereotype of the up-and-comer who graduates from college, gets a job, and immediately buys a nice car.

I drove this car from the time I was 16 years old until I was 31 with a cute toddler. This was right before I parted with it in 2012. I would still be driving it if I could have fit four kids inside.

I once had a new boss ask me for a ride back to the office when we were out at an event. She walked up to my car and said she would just walk to the office! I was humiliated.

In hindsight, I think it shows worse on her than it does on me, but I still felt about an inch tall.

And really by that point, we could have more than afforded a car that at least had working AC. (I still drove the thing until a transmission repair would have cost more than the car was worth.)

7. What’s one thing you splurge on?

Houses, for sure.

I will wear second-hand clothes, forgo restaurants, and drive cars until the wheels fall off, if only I can live in and love on old houses. We bought our one-hundred-year-old row house about fifteen years ago after it had been flipped and we have been slowly restoring one room at a time back to its former glory as we have the cash.

Then just last year we “acquired” my dear departed great aunt’s farmhouse back home.

I put “acquired” in quotes because it wasn’t as simple as a deed transfer. The house was slated for demo by my cousins when no one in their family wanted to restore it. The county wouldn’t let me carve the house property out of the farm, so my cousin sold me a piece of land on the edge of the farm and gave me the house.

We had it moved to the new land in December, and we are now beginning the long work of restoration.

Our “free” farmhouse being moved to our land in December of 2022.

Even though this house was technically free, moving and restoring an old house is a very unfrugal thing to do. And also worth every penny to me.

8. What’s one thing you aren’t remotely tempted to splurge on?

A giant, brand-new suburban house. If the floors don’t creak, I don’t want it.

9. If $1000 was dropped into your lap today, what would you do with it?

I would probably put it into our “spending savings” account.

We are very intentional about our long-term investing, but we drop all extra cash into this account that we use for vacations, work on the houses, and big bills that come up (like medical bills or large-than-anticipated tax bills), etc.

I could turn $1000 into all the second-hand appliances I need for my new old house or a least a couple of the plane tickets for our home exchange this summer.

10. What’s the easiest/hardest part of being frugal?

For me, the easiest part of being frugal is that it means I get to lean into my natural inclinations.

I get joy out of not spending money. I love to get library books, eat cheap, homemade meals, and travel on a dime. I love old things, so being frugal means I get to enjoy good-quality stuff that looks a little worn.

We take a lot of family walks, especially when we are back home on the weekends. Reading library books and taking family walks are my two favorite frugal entertainments. Here I am last fall (red jacket—a Thredup find) with my mom, and an assortment of my children and my brother’s kids.

The hardest part is when frugality means saying no to folks I love and to experiences I want.

No, I can’t take that expensive trip with you. No, we aren’t going to get takeout with you. No, we can’t get a babysitter that night to go to that fun thing.

11. What frugal tips have you tried and abandoned?

As our careers have evolved and we’ve had four children, I’ve had to stop doing things that didn’t give me a high return on my time. For example, we still make most of our bread from scratch because it involves tossing a bunch of ingredients in the bread machine and waiting, and our children eat so. much. bread.

This morning’s batch of homemade bread. Outside you can see the wood of our play equipment. It was a very fancy set that we bought secondhand for a song because my husband and I disassembled it in the seller’s yard and reassembled it in our yard.

While I do still bake bread, I no longer buy most of the kids’ clothes at Goodwill because I just don’t have time to sort through racks in the precious daytime.

Instead, I shop when I have a minute at Thredup. I pay higher prices, but it is worth it in time saved. And it is still cheaper than brand new.

I stopped attempting to garden. I can’t honestly say I stopped gardening because I’m not sure my attempts ever actually qualified as gardening.

As much as I dearly love restoring old houses, I could not care less about learning any of the skilled trades that might save me a ton of money in this restoration work. I used to think I might like to try my hand at something like carpentry, but I’m over forty now, so I’ve given up hoping I would pick these things up.

I would much rather save up the cash from doing the work that I love and pay someone else to do carpentry, plumbing, and painting.

12. What single action or decision has saved you the most money in your life?

From the beginning of our marriage, my husband and I have been dedicated to living below our means.

That decision has forced us to do things like figure out how to travel cheaply if we want to travel at all. It has also made us be very honest and intentional about how we spend money on the kids.

We could spend a fortune on kids’ clothes and private school and afterschool activities.

But making the decision to keep our spending below our income means we are constantly asking ourselves the question, “Do we want to make this purchase because:

- the kids will truly benefit in a meaningful way

- we are trying to make up for something we wished we had in childhood

- we think we are supposed to buy/do this thing to make us “good parents”

14. What is something you wish more people knew?

I wish, wish, wish more people knew the power of investing even small amounts consistently in index funds over time.

My husband and I started investing for retirement when we got married. Even when kids and career changes have made our income tighter at times, we’ve always managed to put at least a little bit away.

Twenty years in we have built up enough of a nest egg that, even if we don’t add a dime more, we will be able to retire with all that we need.

15. How has reading the Frugal Girl changed you?

I learned how to bake from reading The Frugal Girl.

Kristen’s recipes and tips are so practical and clearly communicated in a way that someone like me, who doesn’t actually like to bake, can understand it.

(Note from Kristen: here’s a collection of yeast recipes for you to peruse!)

The Frugal Girl’s focus on being frugal, not cheap, has had a huge influence on me.

I have been known to veer into cheap territory, but I usually regret it when I do. Thank you, Kristen, for helping me understand the difference! I bought those gold bread pans early in my baking journey, and they have paid for themselves many times over.

Finally, I appreciate Frugal Girl’s witness.

I have been a Christian since I dedicated my life to Christ as a child. I have deeply lamented the surge in Christian nationalism among my fellow believers in the last few years.

(As a scholar who studies race in American history I can tell you that tying Christian symbolism and ideology to racism and xenophobia has been around too long.)

But I have not wavered in my faith. That is in part because I am surrounded by enough Christians in real life and online whose witness reminds me that God is still God even when humans twist and appropriate his scripture.

16. Which is your favorite type of post at the Frugal Girl and why?

I really love it when Kristen describes how she intellectually works through issues of finance and frugality.

I’m thinking, for example, of the recent post “What Did You Buy that You Didn’t Absolutely Need.” It is a wonderful discussion about the nuances of frugality and spending. It made me think deeply about how I approach my own spending decisions.

17. Did you ever receive any financial education in school or from your parents?

My parents were founts of financial wisdom!

They were very open about their finances with us as kids, and I remember hearing them talk through their own financial decisions. When I was born my parents lived in a trailer, which they upgraded to a double-wide when my brother was born.

All of my friends had nicer homes, but I remember my parents talking about how living in a cheaper house meant they could pay off their mortgage when so many of their peers were living deeply in debt. I hear lots of experts talk about teaching children about money through allowances.

I never had an allowance. I think watching my parents make financial decisions and describing the why behind those decisions made a much bigger impression on me than giving me an allowance each week.

We did have a kind of financial education class in high school.

Our chemistry teacher was assigned to teach a course called Global Economics, which she, for some reason, turned into a makeshift personal finance course. Long story short, she wasn’t any better at teaching us personal finance than she was at teaching us chemistry.

But I do remember that the capstone assignment was to chart out our plans for college and beyond. The simple assignment of forcing me to think through which college majors lead to what jobs and what I wanted to do for work one day was powerful for me.

18. Do you have any tips for frugal travel or vacations?

Oh boy. We’ve been known to go on vacation for what we would have spent if we stayed home.

I mentioned home exchange. I would add to that discussion that if you want to home exchange you have to be flexible about when and where you travel.

When we were contacted by a couple who had a house in Southeast Utah, my husband said “what’s in Utah?” I said, “I think it looks like the movie Cars. Let’s go!” We had the time of our lives seeing some of the most beautiful scenery in the country, learning about the Indigenous communities in the area, and floating down a desert river (sometimes in a boat and sometimes just wearing a life vest).

Just like at home, you have to plan meals and schedule your time, especially if you are traveling with kids. Maybe your plan is to get takeout and eat it in a park, but have a plan (that has some flexibility in it) all the same.

When I am feeling super frugal, and we will have a kitchen, I plan meals before we even leave. Then I can bring expensive but easy-to-transport things like spices and oils with us and avoid buying small sizes of these things at the grocery store when we arrive.

One of my favorite pieces of frugal travel advice comes from Rick Steves: assume you will be back. Then when you travel you don’t put pressure on yourself to do all the tourist stops in one trip. It makes space not only for saving money, but also for experiencing “real” life like a local.

For example, when we went to Iceland the first time, we didn’t do Blue Lagoon. Instead, we went to one of the local municipal pools. It was an amazing experience: we hung out with locals, the kids got to play on water slides, and it was only a few bucks to get in.

Lo and behold, a couple of years later we were back in Iceland for a wedding. This time we did make time and money to go to the Blue Lagoon-like facility in the west of Iceland, complete with blue, milky water and sulfur smell. I wouldn’t change a thing about either trip.

Finally, do your research ahead of time.

Is public transportation easy to access in this location?

How do locals save money?

What seems like more tourist trap than travel experience?

There’s nothing wrong with a little tourist trap fun, but know what you want to experience before you accidently shell out $100 for something you don’t. Knowing the history of a region might even send you to some off-the-beaten-track neighborhoods and experiences.

_______________

Amanda, it made me smile to see your bread pans and cooling rack; it was like looking at a scene from my own kitchen!

Also, I loved to see your house being moved via truck because my South Dakotan aunt and uncle actually did that with their big old Victorian house.

This is the house they moved into town from the country

And I love the photo of you in front of your Civic. It almost looks like a vintage car ad, and of course, you know how I feel about Civics. One day I will have one, hopefully.

But I will shoot for a model a little newer than yours! 😉

Readers, the floor is yours!

The post Meet a Reader | Amanda, a Virginian historian appeared first on The Frugal Girl.